- OptimistiCallie

- Posts

- 🪩 New kids on the block

🪩 New kids on the block

Why newly public stocks are getting so much love

Hey hey, happy Monday.

Team, we made it to the end of summer! Just a few months, and we’ll be talking about the Santa Claus rally (not like anybody’s counting, not me! Santa, I’ve been good this year!).

Before we get into it, check out my latest Business Insider piece on the frightening decline in the labor supply, and why the job market signals are so whack these days (warning: it’s behind a paywall, sorry in advance/pay for good journalism!).

ALSO: I have exciting news. OptimistiCallie will be coming at you TWICE A WEEK for the next month or so, thanks to a collab with everybody’s favorite chart connoisseur, Chart Kid Matt. I’m not sure if you’re aware, but Matt C is one of my research colleagues at Ritholtz, and I thought it would be neat to give you a glimpse into how we both think about the world through the week’s best charts.

Introducing… 📈 THE CHART PACK 📈, a collection of charts every week with our collective commentary. Like a conversation we have on the desk, but for the whole world to see. Coming to your inbox this Thursday. In the meantime, subscribe to Matt’s newsletter here.

AND! If you’re going to Future Proof in just a few weeks but haven’t snagged a ticket, click the link here for a sweet discount, courtesy of the Compound crew. Because good things come to those who wait 😉

OK, enough housekeeping. A 4-minute read on the wild world of new public companies, and why investors can’t get enough of IPOs today.

Smash the button below to share OptimistiCallie with a friend 😊

First, a word from a gracious sponsor…

Syntax Direct – The only enabling technology platform empowering RIAs to engage in Direct Indexing

Syntax Direct empowers financial advisors to design hyper-customized portfolios in seconds, generating back-tested indices with full transparency. Scale your business, meet diverse client needs, and integrate seamlessly into existing tech stacks and order management systems. |

It’s rough being the new kid.

You walk into school that first day, not knowing a single soul staring back at you in the hallway.

Your haircut is weird, your clothes are out of style, and you get that awful feeling that you just don’t belong cue hallway animal fight scene from Mean Girls.

Eventually, you find your crowd, but it takes time. Especially if you want to sit at the cool kids’ table.

The stock market has its fair share of new kids with weird haircuts and clothes. But instead of treating them like the outcasts, investors are welcoming them into the hallways with open arms.

Initial public offerings (IPOs) – or the process by which a company debuts on the stock market by selling shares – are few and far between these days, yet they are getting some of the best reception in years. Businesses and consumers may be cutting back on spending, yet investors are throwing caution to the wind to get to know that cute new boy who we’ve never seen around these parts.

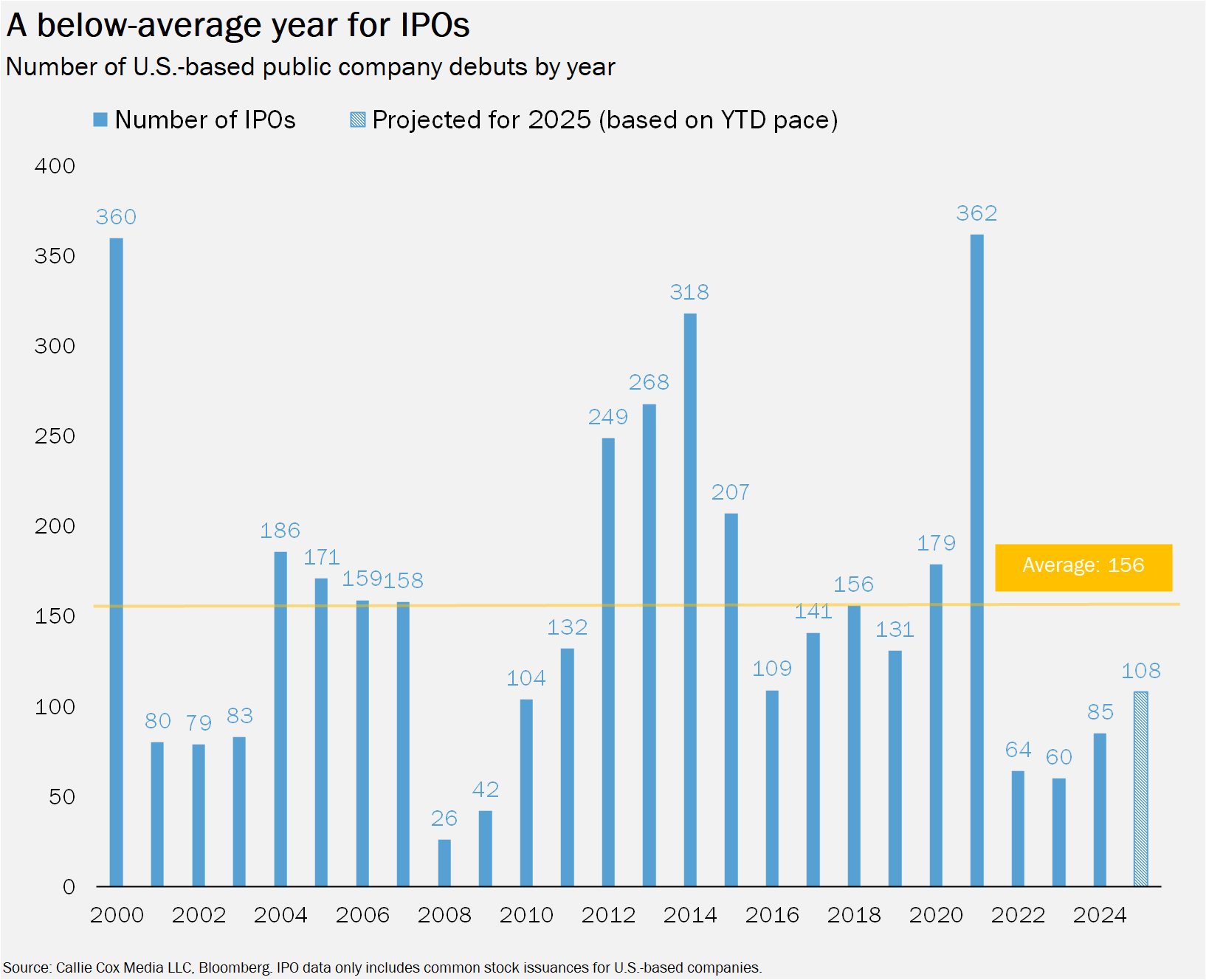

In 2025, just 62 companies have gone public. At this pace, we may only see 108 IPOs this year, much lower than the average of 156 each year since the beginning of the century.

But man oh man, do we love these new kids.

Shares of new companies this year have surged an average of 35% in their first day of trading, making 2025 the most successful year for public debuts since at least 2000.

The stories are even more stunning. Shares of Circle Internet Group jumped 169% on the stablecoin issuer’s first day of trading, the strongest IPO performance for a billion-dollar issue since Airbnb in 2020. Then, less than two months later, Figma (an online design platform) took the top spot with an eye-popping 250% jump on its first day.

And in a situation the market gods probably had a good laugh about, a crypto exchange named Bullish soared 84% in its first day of a $1.1 billion IPO.

The cool kids haven’t just commanded the cafeteria. They rule the entire school.

Analogies aside, you have to wonder what this IPO euphoria tells us about the future of the stock market.

Maybe the investment bankers have it all wrong. They’re constantly underestimating just how hungry America’s investors are for the next big thing.

Consider the mechanics of the public offering. We all see the confetti and cheers at the New York Stock Exchange on opening day, but few of us are privy to the scrambling and number-crunching behind the scenes. In the lead-up to an IPO, public company hopefuls hire a bank to evaluate what different types of investors would pay for shares (and honestly, what the company is worth at that moment and in the near future). Then, these same bankers take the show on the road – pitching the IPO to Wall Street firms. The offer price – or the initial price at which the company sells shares at – moves up and n based on these firms’ demand.

I think there’s something here. Wall Street has been vocally downtrodden about the path ahead (OK fine, guilty as charged) given the economic obstacles, while the rest of America has been buying unprofitable meme stocks with their eyes closed. Perhaps the sour roadshow reception and the fear of a big bust on opening day have kept Wall Street’s IPO hopes ultra conservative, only for individual investors to blow these tepid expectations out of the water once the shares start trading.

The average IPO size is down 12% from the go-go days of 2021. Then again, there have been six IPOs that have been valued at a billion dollars or more this year, more than 2022 to 2024 combined.

Or maybe there’s more appetite for new ideas because we’re living in this renaissance era of AI, and the benefits of this freight train of a technology are becoming more obvious by the day. Possibly. According to Bloomberg data, only nine U.S. tech companies have gone public this year (no, I’m not counting those silly SPACs in any of my stats!), yet the share price of three tech companies has doubled on the first day.

Also, tech IPOs have performed better on their first days than any other sector this year (warning: we’re talking about small sample sizes here).

Perhaps it’s as simple as supply and demand.

Class, open up your textbooks!

When the supply of an item can’t meet the demand, the price goes up.

By how much? It depends. That’s tomorrow’s lesson, kid.

2025 has been a below-average year for public offerings, and investors simply want more. Can you blame them? Investing is easier than ever, and people are clamoring over early exposure. You can see this in the furor over private equity and venture capital. We just want that edge, no matter where it comes from.

Household cash levels are still high, and there’s a huge confidence gap between high-income and low-income Americans. Some investors clearly feel comfortable enough to spend some cash on speculation.

I’ve stared at IPO data for a while, and I’ve come to two conclusions.

One: the IPO market alone isn’t a sign that things are overheating.

In the past, we’ve seen companies and investors get overly excited right before the market turned on them. That’s not the case today. You can love all of the new kids without jeopardizing your social status. They’re actually kind of OK, even if Wall Street is giving some side-eye.

Besides, you can’t just say we’re in a b-word, c’mon.

Also, there is no guarantee these new cool kids stick around forever.

Be careful, eager IPO investors. The new kid can run afoul of the head cheerleader, or say the wrong thing to the hunky quarterback. Commit a social mistake so cringe that they have to transfer again.

A good idea doesn’t always translate into a sustainable business, even if people cheer extra loud on the first day. You can see this in the graveyard of failed companies and ruined stock prices of public offerings past.

Like 2021, the latest boom year for public debuts. Just four years later, and 23% of companies that IPOed in 2021 have been taken off the stock market for one reason or another (an acquisition, a private takeout, bankruptcy). About 57% are trading below their offer price, an unofficial failure of sorts.

This, in a year when IPOs were popping off and nobody thought they could miss.

Don’t be the kid who peaks in high school.

Or the investor who puts it all on the line for the golden-ticket stock that turns into mental torture.

Thanks for reading!

Callie

Like what you just read? Share it with a friend, pretty please 😊