- OptimistiCallie

- Posts

- 👯♀️ Déjà vu

👯♀️ Déjà vu

Have we been here before? Not exactly.

Hey hey, happy Monday.

It’s the summer of rate cut hopes. Again.

Bond markets are factoring in an 84% probability of lower interest rates coming September 17, just like they were about a year ago. In fact, I wrote about last year’s situation here, and I’ve found myself digging up spreadsheets from back then to explain what’s in the cards today.

But it’s a vastly different situation, even though the stock market is edging up the same way heading into the fall. A 4-minute read on why the stakes are so much higher for a rate cut, and why an air of desperation may be ahead.

BTW! If you’re going to Future Proof (wealth management’s coolest event of the year) and haven’t registered yet — I’ve got a sweet lil discount link for you. Register here ASAP! Spots are limited.

Smash the button below to share OptimistiCallie with a friend 😊

First, a word from a gracious sponsor…

DIA: Global Reach, 30 Stocks, One ETF

Want a smarter, more time-efficient way to invest in America’s corporate giants? Access 30 of the most reputable US companies in a single trade with DIA — the only ETF that tracks the Dow.Wherever you’re headed, getting there starts here. |

Important Risk Information

Before investing, consider the funds' investment objectives, risks, charges and expenses. To obtain a prospectus or summary prospectus which contains this and other information, call 1-866-787-2257 or visit www.ssga.com. Read it carefully.

Investing involves risk. ALPS Distributors, Inc. (fund distributor); State Street Global Advisors Funds Distributors, LLC (marketing agent).

Adtrax: 8225682.1.2.AM.RTL DIA000728

Expiration: 8/31/26

It’s an all-too-familiar scene.

Stocks are flip-flopping between caring more about a flailing economy or simmering inflation after a dicey July jobs report. Wall Street bond nerds are convinced the Federal Reserve will lower rates in September.

Small stocks are crushing it…until they’re not. People keep talking about the yen. It’s hot as hell outside and you’re cringing over your energy bill and praying to your higher power that this summer would just end, please.

Hold up, do you feel that?

Déjà vu. We’ve been here before.

In fact, it was just a year ago that all of these observations would’ve been true.

Much of summer 2024 felt like Wall Street hit the easy button (minus a scary August swoon from a series of unfortunate events).

This year has largely been the same. A summer full of change, yet little recognition from the stock market as we head for a much-anticipated rate cut. The first in nearly nine months, which feels like a small consolation prize for all the headlines we’ve endured. At least investors see it this way – we deserve a little treat every once in a while, OK?

Be careful, though. We are operating under vastly different circumstances.

Today, a rate cut would reek of desperation, even though Wall Street’s recent moves would tell you otherwise.

What’s this rate cut business you keep referring to?

Good question. Let’s begin with a primer on the Fed and interest rates. Both topics can get complicated quickly, so I’ll unpack both here.

Skip to the next section if you’ve heard this before.

Rate talk can get nerdy quickly. Yield curve inversion, term premium, bond laddering…it’s like a ball pit for textbook-touting know-it-alls.

But let's not get into that. Ninety percent of it is Wall Street trader jargon that doesn’t affect everyday folks like you and me. What matters are the basics: how interest rates are set and how they impact your financial decisions.

Many of us know that interest rates are what you pay to borrow money. Or, what people (or banks) pay you to borrow your money.

Few understand that a small group of academics in DC has a big hand in setting these rates.

I’m talking about the Federal Reserve. The Fed exists to balance the economy through interest rates and other nifty tools in order to keep Americans employed and able to afford things. Seriously, the Fed has two jobs: maximum employment and stable inflation.

To maintain this balance, the Fed’s biggest tool is the Federal funds rate – the rate banks pay to borrow overnight from other banks. They adjust this main rate through cuts and hikes to either stimulate or cool down the economy.

A lower Fed rate typically means cheaper loans across the board. And when borrowing money is easy and cheap, you’re less incentivized to save and more willing to spend and invest. The increase in spending juices the economy, boosts innovation and lifts spirits.

So, about that rate cut…

People – from neighbors and family members to the President – have started to beg for the Fed to lower rates, claiming that a series of cuts could lead to (desperately needed) lower mortgage rates and a jumpstart for the job market.

However, the results can differ.

Sometimes, one rate cut does the trick. Maybe two or three. The Fed steps in at the right time, successfully drives the economy away from crisis, and the stock market cheers. I call these celebratory rate cuts, and since 1970, they’ve happened about 39% of the time.

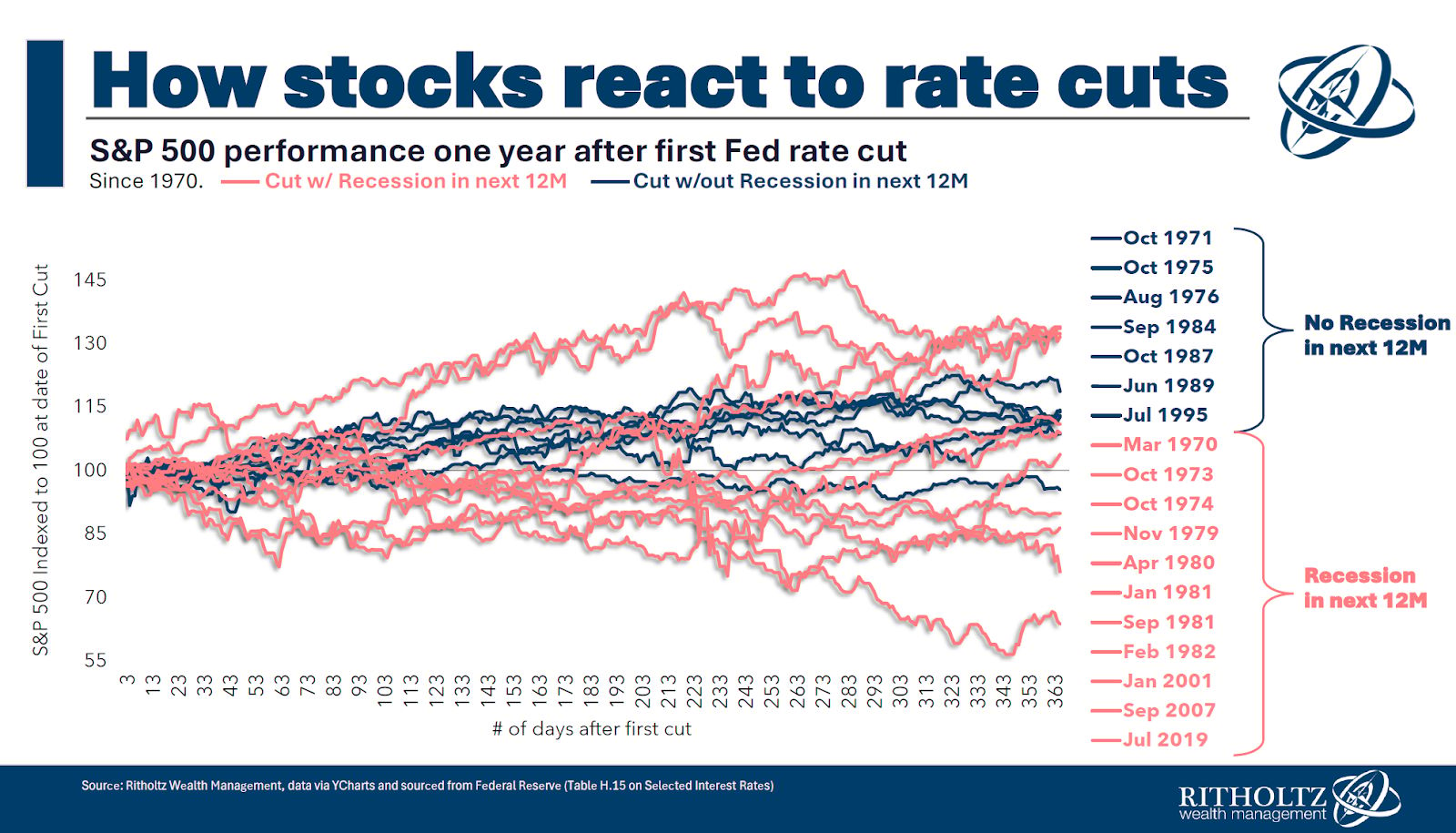

The stock market loves a celebration, too. When the Fed cuts rates and a recession doesn’t materialize in the following 12 months, the S&P 500 has been up an average of 11% over those 12 months. The S&P 500 only crashed once in that period, too (October 1987, which was more of a technological glitch than a product of economic calamity).

More often than not, though, the Fed hasn’t been able to save us through rate cuts. It’s too late for the interest-rate lever to do anything because the economy is already on the edge of – or in – recession. These are desperation cuts, and over that same 55-year timeframe, they’ve happened about 61% of the time.

As you can imagine, a recession doesn’t bode well for the stock market. When the economy falls into a crisis within 12 months of the first rate cut, the S&P 500 has crashed 10 out of 11 times.

Look, saving the economy ain’t easy. Cut our interest-rate superheroes some slack.

This question of celebration versus desperation is what separates good from bad in a rate-cut world.

Last year, you could make an argument that the Fed was in celebration mode. The unemployment rate was rising, yet the level of inflation had decreased for 11 out of 12 months. Part of the shift in inflation was due to cooler price growth in services – rent, haircuts, vet bills, airplane tickets. The kind of demand-driven inflation the Fed can influence with policy.

The Fed didn’t exactly stick the landing, though. The economy avoided disaster, but long-term interest rates – the kind that dictate what we pay on mortgages and auto loans – actually rose because the bond market (which determines the path of long-term rates) got too excited about growth prospects. A small price to pay for keeping our jobs, but alas, not perfect.

If the Fed’s 2024 act was tough, today’s situation is next-level difficult. The job market is arguably in a worse spot than it was a year ago. I have receipts:

Even trickier, inflation is moving in the wrong direction. Goods and services prices have actually accelerated in the past two months. Yes, tariff-affected goods are the core of the inflation problem, yet services prices are mysteriously heating up too.

The numbers tell us an inflation crisis is brewing. I wouldn’t go that far, but I do think it’s fair to say this.

The Fed is failing at both of its jobs right now. It looks like they’re getting desperate.

So that déjà vu you’re having…

Snap out of it already.

We may be in a situation where the Fed saves one side of its mandate, but not the other. We get a rate cut, but long-term rates rise and mortgages become even more expensive.

Or we get a (sorely needed) rate cut when it’s too late to save the economy. Rates come down as unemployment surges and job market woes intensify. You get affordable housing, but at the expense of your job. Trust me, you don’t want this.

The stock market thinks we’re in a place where we can get lower rates and a healthy economy. Yet the trends are dire, and we still have another round of higher tariffs to process.

Here’s the good news: Fed chair Jay Powell may be stuck, but you’re not. You, dear investor, have lots of agency here. Nothing is a foregone conclusion.

Fill up that emergency fund. Write a crash plan for lower stock prices. Control what you can control.

But don’t get lulled into a false sense of security based on recent history. Stay level-headed about what’s at stake.

Thanks for reading!

Callie

Like what you just read? Share it with a friend, pretty please 😊