- OptimistiCallie

- Posts

- 🫧 The seven rules of stock market bubbles

🫧 The seven rules of stock market bubbles

A few universal truths about the b-word

Hey hey, happy Monday!

Bubble talk is boiling over again. Your mom, uncle and cousin are making not-so-subtle references to the dot-com days. Market experts keep complaining about the PE ratio, whatever that is.

Let’s talk about it.

A 6-minute read on the seven rules of stock market bubbles (er, b-words).

Smash the button below to share OptimistiCallie with a friend 😊

First, a word from a gracious sponsor…

Equities plus income

QQA, RSPA, and EFAA aim to provide consistent monthly income and growth potential. |

Stock market bubbles are so misunderstood.

They come out of nowhere, blow bigger than anybody expects, and pop when the biggest haters come around to them.

When the dust settles, we pick them apart. What was the signal? When did you know? What investment could’ve saved us?

And then, it happens again. We all fall for it, too. Tale as old as time.

Bubbles are the great equalizer. We are all powerless in this quest to logic out the illogical.

Yet everybody – from your broke cousin to your Uncle Tony to that gold-crazed expert on CNBC – swears we’re in the biggest bubble of all time. Like they’ll be the only ones on Earth to call the exact crescendo of a market rally. Except they won’t be, because you can’t call a market top more than once. That’s just a boy crying wolf.

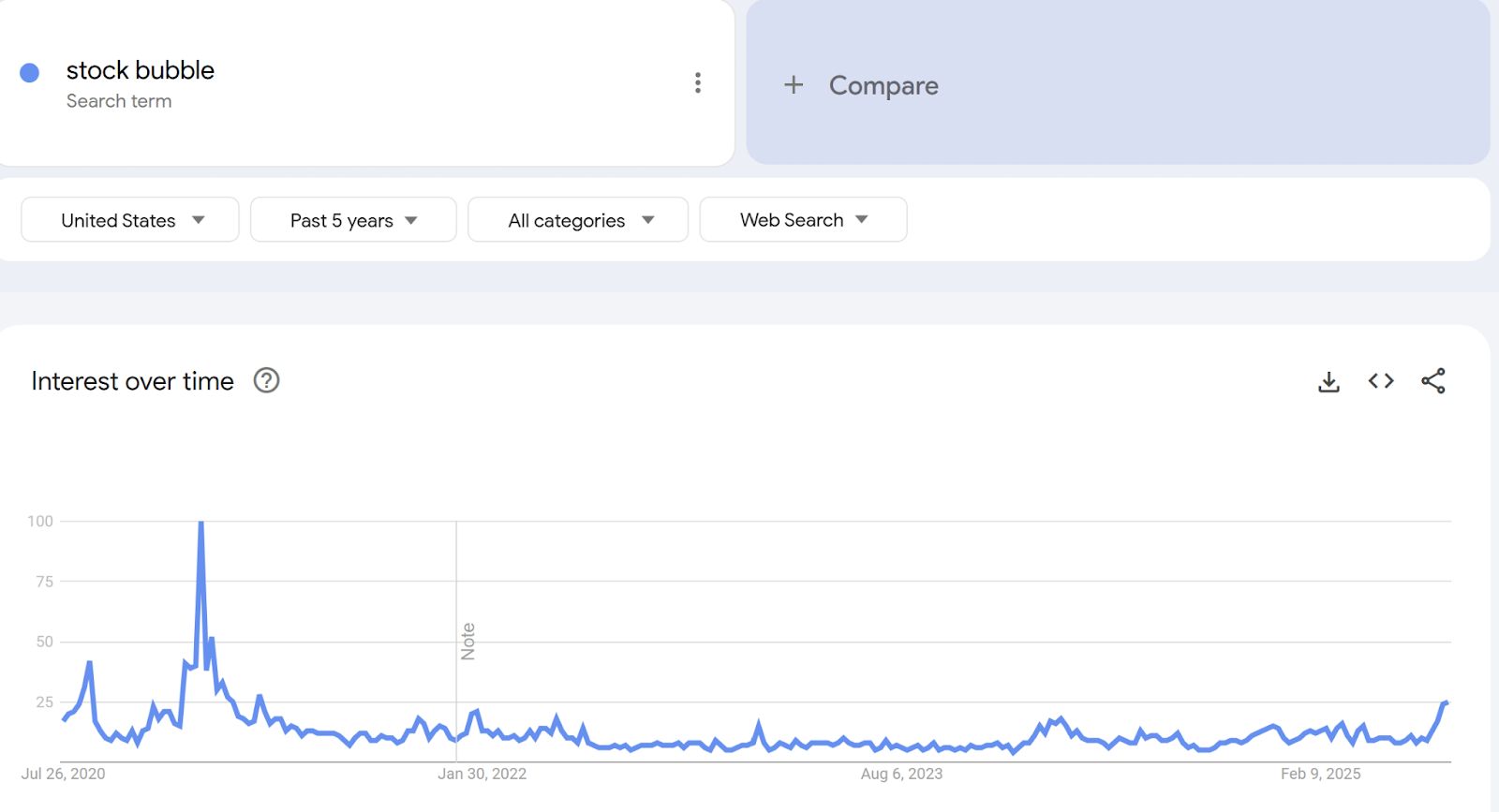

Today, the bubble talk is heating up again. Google tells me that searches for “stock bubble” have reached the highest level in four years.

Call it a product of the resurgence in meme stock trading, or just a natural skepticism of one of the strongest rallies of all time.

Instead of getting caught up in nonsense, let’s establish a few universal truths for speculating about – and investing in – a so-called market bubble.

Excuse me, the b-word.

Rule #1: You do not say the word “bubble”

ChatGPT defines a stock market bubble as “a situation where stock prices rise far above their actual value—driven by exuberant investor behavior rather than fundamentals like earnings or economic performance”.

This is technically correct. High-fives to our AI overlords.

Spotting a bubble, however, is exceptionally more difficult than just going by the book. The stock market trades away from earnings and economic data all the time, at least on a day-by-day basis. Inexplicable moves by themselves don’t signal a bubble is forming. Sometimes, investors are rightfully sniffing out a trend that has yet to materialize in hard data.

Bubbles can only be spotted in hindsight because you know how the story ends. That’s why you’ll never hear me opining on whether we’re in a bubble right now. Nobody knows how much is too much.

That’s why you should just strike “bubble” from your investing vocabulary. Don’t even go there.

Rule #2: You do not say the word “bubble”

Yes, I’m invoking Fight Club here. Do NOT say the word bubble.

From here on out, we will only refer to it as the b-word.

Rule #3: Prices will rise higher than you think

B-words tend to form when stock prices shoot higher.

But that doesn’t mean a b-word is forming just because stock prices shoot higher.

From April 8 to July 10, the S&P 500 – an index of America’s 500 largest publicly traded companies – jumped 26%, its 12th largest three-month jump in history.

Sure, that stat alone gives off an air of excess. But in the past, rallies of this magnitude largely haven’t led to immediate doom. Rather, they’ve signified a quick recovery after a painful selloff washes out speculation. You could make a case that the 19% drop in April fits this bill, even if the recovery has been a little more mysterious.

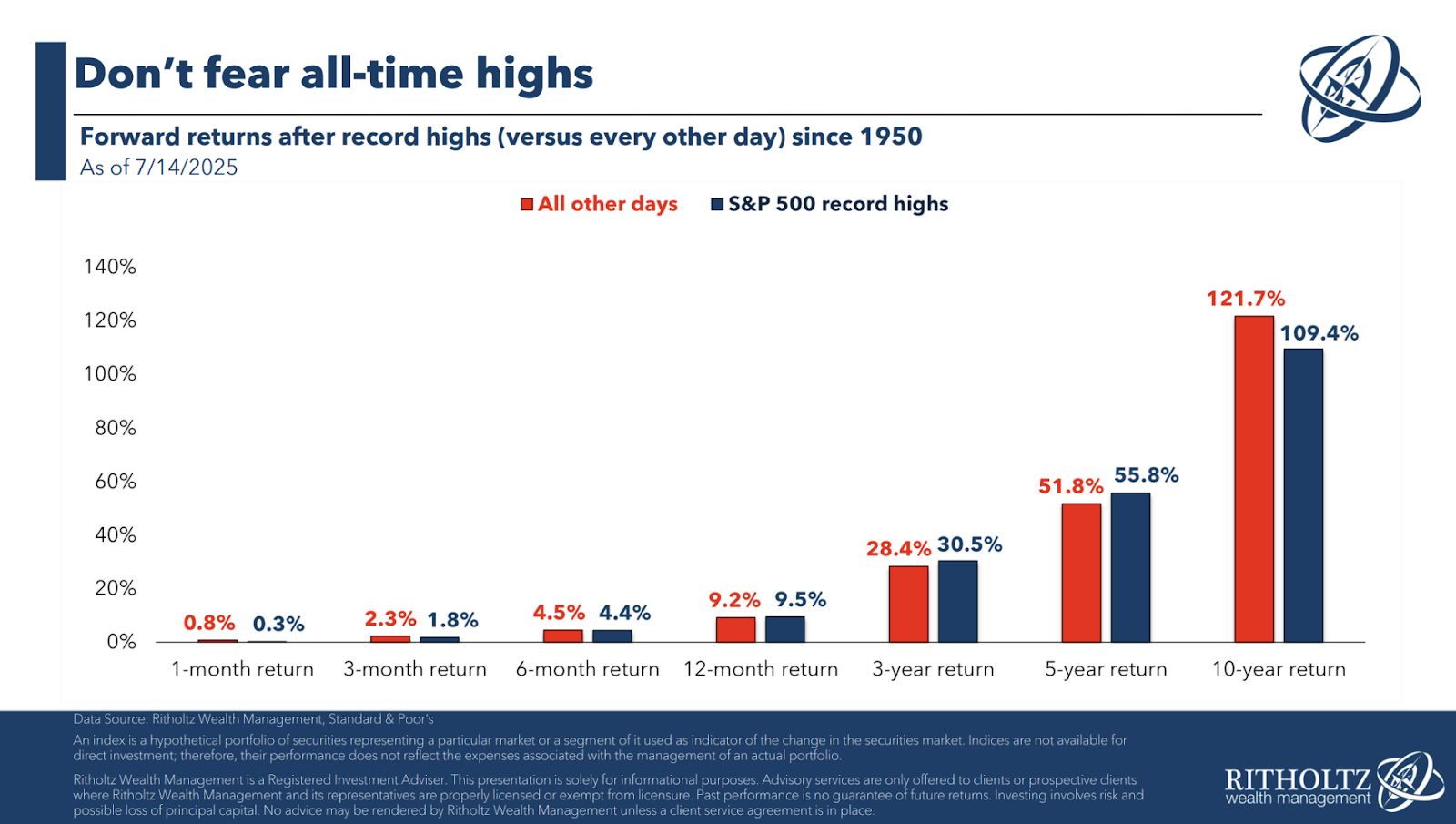

Also, record highs rarely mean stocks have reached a dangerous top and are ripe for a crash.

Since 1950, 80% of S&P 500 record highs have led to at least one more record high in the following week. And in the past, if you’ve bought stocks at record highs, you’ve enjoyed respectable returns over several timeframes.

Rule #4: Prices do not define value

You can’t judge a market on price alone. Doing so ignores a lot of crucial context as to why prices are so high.

Often, people think of the stock market as an item on sale. If the price falls by 20%, consider it the same as 20% off your favorite t-shirt. Be honest, you’d probably buy it.

This analogy isn’t necessarily wrong, but it leaves out the idea that value doesn’t necessarily equal the price of an item’s components.

Let’s use the t-shirt example. Sure, the materials used to make the shirt cost $1, but in your eyes, the shirt is worth $50 because of the design, style and label. A 20% off sale may convince your friend to buy this shirt, but at a $50 price tag, you’re sold.

Some aspects of value are concrete. Others are left up to interpretation.

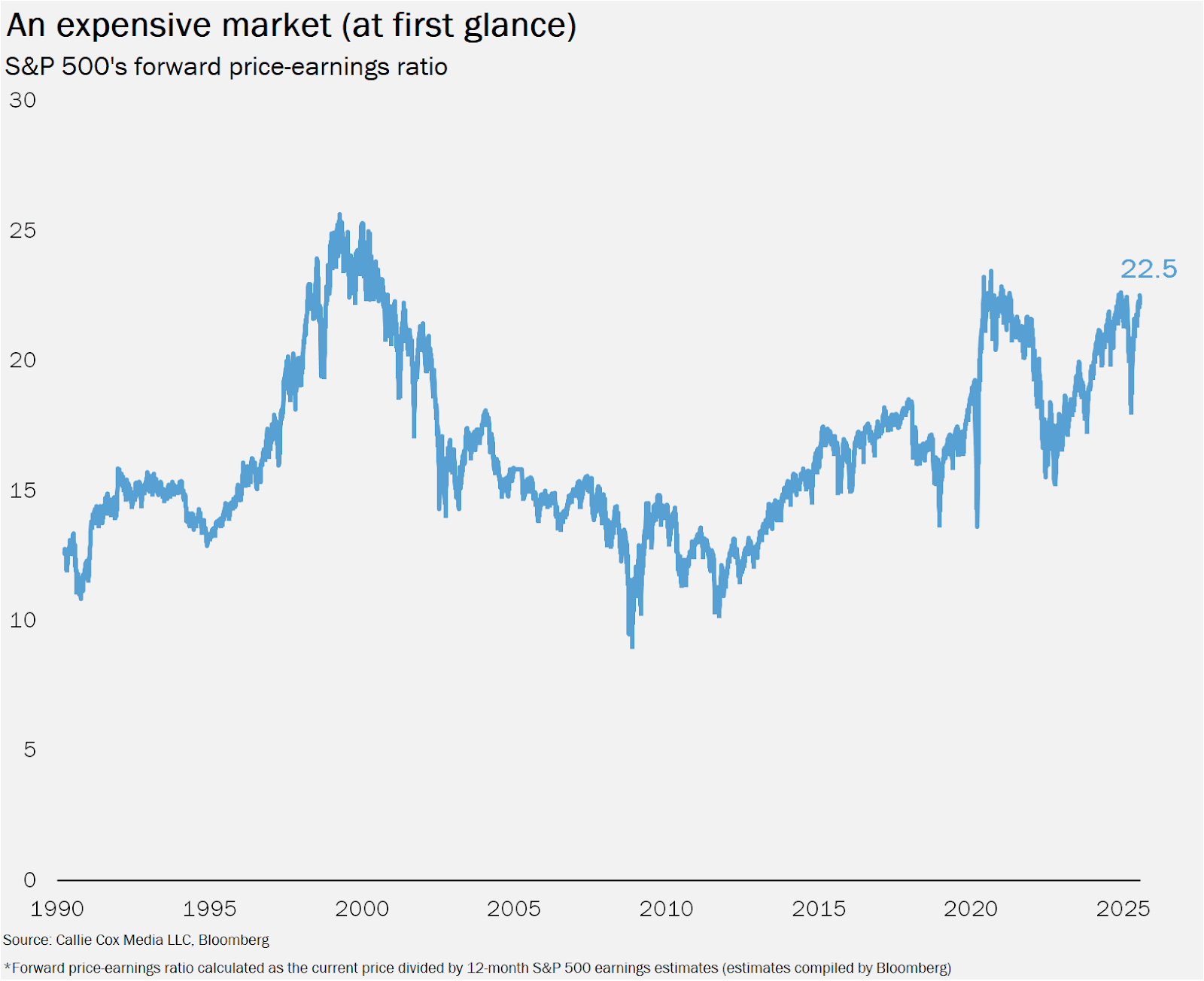

Therein lies the importance of the price-earnings (PE) ratio – a measure of where a stock or index is trading relative to the profits it’s expected to generate over the next year. A company’s profits may be an undeniable number, but its growth trajectory may be different depending on who you talk to.

Just because prices are unmoored from earnings doesn’t necessarily mean that the value isn’t there. Therefore, even PE ratios alone can’t tell you much about the stock market’s future.

This is one of the trickiest aspects of today’s market. The S&P 500’s PE ratio is around the highest since the early 2000s.

The tech-heavy Nasdaq’s PE ratio is near a five-year high. You could argue that’s a fair value if AI promises to turbocharge profits and tariffs aren’t as scary as some fear.

Calling a b-word requires you to guess the intentions of the entire investing population. Good luck with that.

Rule #5: Prices do not define the idea

This is where b-word talk can get heady. Often, market excess aligns with a new idea or innovation that captures the hearts and minds of the world. We collectively dream about a bright future ahead, and invest in the companies and products that we think could benefit from the exciting trend.

Today, that idea is AI. And while I could spend a whole newsletter outlining the pros, cons and myths of AI (and I kind of did that here), I think it’s a compelling technology.

We are in the dreaming days, too. The promise of AI is one of the reasons the S&P 500 has notched two straight years of 20% gains and has managed to stay afloat in a year of chaos.

B-words grow until people aren’t willing to dream anymore. One headline (ahem, DeepSeek) can throw off the entire market. When that happens, investors cling to any tangible data they can find that proves the narrative is still intact. Sometimes, the burden of proof is too high for the moment.

This is how you fall into the b-word trap. You intertwine the success of the idea and the market. You think AI is going to change the world and prices will grow forevermore, or you think AI is an overhyped technology that will amount to much less than what the world thinks. In reality, AI’s fate probably lies between two of those goalposts, and the market will eventually calibrate to its potential.

Think about the Internet. The world wide web’s creation led to a decade of tech stocks posting double the return of the rest of the market. Yet, the promise of the Internet didn’t prevent the tech-heavy Nasdaq 100 from falling 80% in two and a half years.

The idea of the Internet wasn’t faulty. The expectations around the idea simply got ahead of reality, especially during the Y2K craze.

Rule #6: Keep your balance

Let’s say the haters are right and the market is indeed in a b-word, soon to pop in a grand fashion.

Even then, you don’t need to be afraid. Just because the stock market looks a little off-kilter doesn’t mean your portfolio has to be. You have agency here.

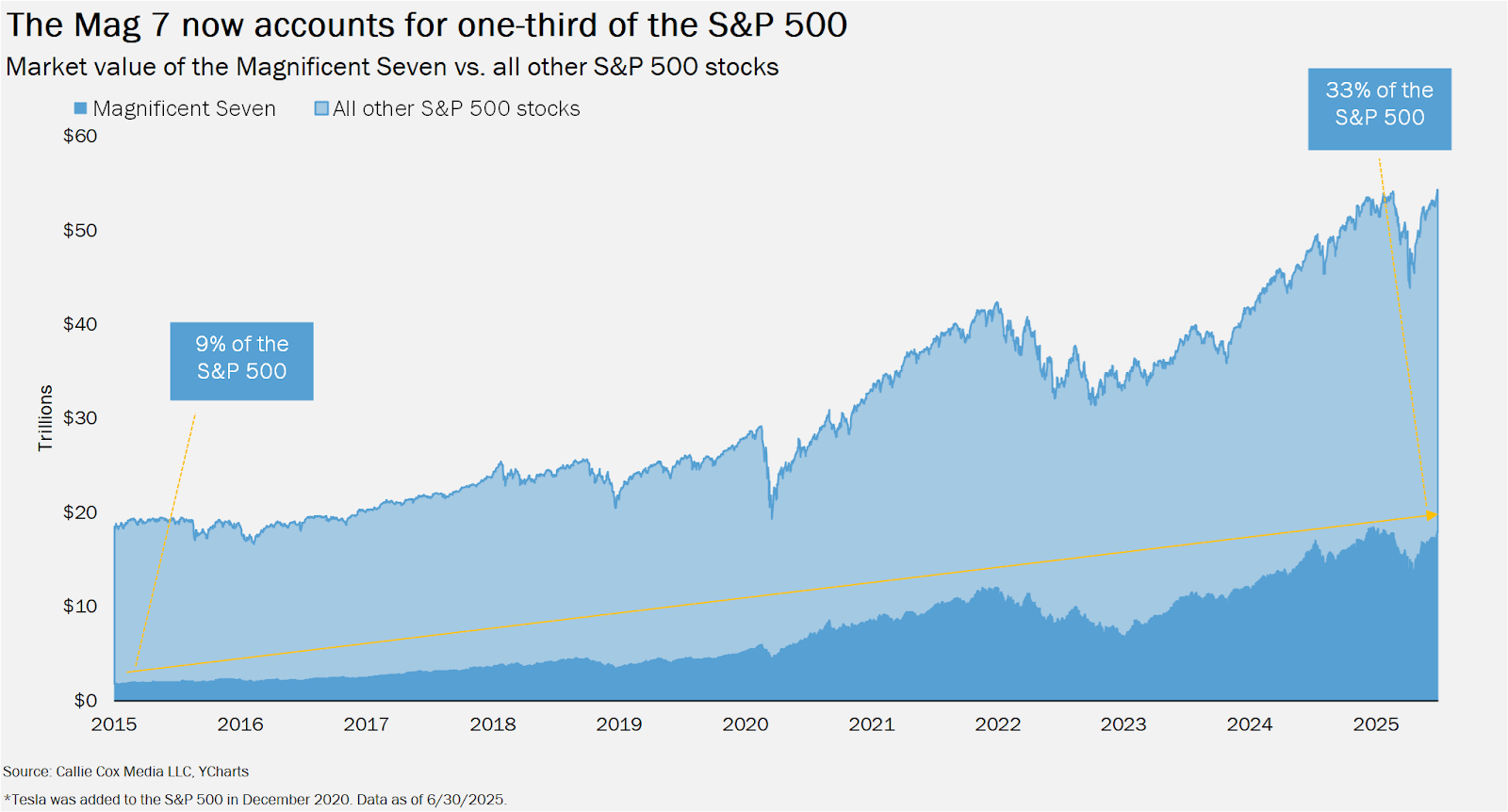

For one, it’s so important to know what you own. If you’re a passive investor loaded up on S&P 500 funds, about a third of your money is invested in the Magnificent Seven.

Don’t freak out, though – you can hedge around those S&P 500 holdings through bonds and cash to make sure you’re prepared if prices fall. Just being aware of your risks is a step in the right direction.

Or if you have more control over your stocks, just sell a little bit of tech and put the proceeds in more stable, predictable areas of the market.

Rule #7: Remember your humanity

The most important rule.

Investing is never easy. I’d argue today’s environment is particularly tough with all the noise surrounding us. It’s also natural for us to anchor on past experiences. No wonder your mind is rewinding to the 2000s malaise or the early meme stock days.

You don’t have to participate in the b-word talk. In fact, I’m giving you a pass today to tune it all out.

Thanks for reading!

Callie

Like what you just read? Share it with a friend, pretty please 😊