- OptimistiCallie

- Posts

- 😵💫 How to invest without going insane

😵💫 How to invest without going insane

On purpose, process and progress

Hey hey, happy Monday!

Life updates and investing lessons all in one. We love to see it.

First, check out my latest Business Insider piece on Gen Z’s unemployment crisis, with a few words of wisdom from somebody who graduated into a 13% unemployment rate for 20-24 year olds. Fair warning, it’s behind a paywall (sorry!).

And today, a few words – primarily from personal experience – on what helps me focus on what’s best for my portfolio when life feels out of control.

Also…🚨 ADVISORS, WE WANT YOUR THOUGHTS 🚨

We’re writing a research paper on how you use crypto in your practice, and we need your help! Give us five minutes of your time to take our survey and be entered to win a $100 Amazon gift card! Here’s the survey (for financial advisors only), thank you in advance!

Smash the button below to share OptimistiCallie with a friend 😊

First, a word from a gracious sponsor…

Dividend Income ETFs Have Exploded ~100x In Seven Years.

Investors are demanding a creative approach to cashflow. Shelton Equity Premium Income ETF (SEPI) offers just that—it's active, it's differentiated, and it's inspired by Shelton Capital Management’s established Overall Morningstar 5-star Flagship Fund, EQTIX. |

Successful investing is more than just achieving a level of returns for a certain period of time.

It’s about staying sane while achieving a level of returns for a certain period of time.

Most weeks, we talk about returns. This week, we’re talking sanity.

Selfishly, because I feel like I’m losing mine these days.

In case you haven’t heard, my husband and I are expecting twins in January. Maybe sooner, because twins can come much earlier than one baby.

These past several months have been a blur of doctor’s appointments, well wishes and puke sessions (just being real with y’all!). Lately, the baby prep has ramped up even more – we’re talking daycare tours, furniture deliveries, birth prep classes, even a cardiology visit. That’s a fun story that I’ll save for friends over mocktails.

Amidst all of this, we are hemorrhaging money. Three thousand here, one thousand there. Casual tens of thousands set aside for childcare. Plug your nose and buy all the things. Kids are expensive, and we’re establishing the lives of two kids at once.

We are blessed and stressed. Booked and busy. Knowing we are in the midst of some big financial decisions, but literally no time to think most of them through.

I know I’m not the only one here.

Life can get overwhelming at times. Heck, even investing can be overwhelming at times. What to buy, what to sell, how much to risk, what to pay attention to in a seemingly endless stream of noise. Sanity is no guarantee, OK?

If you’re nodding along to this, then hey, you’re in good company.

But we have to prioritize our sanity, folks.

Here’s how I’m staying sane.

Find your why.

Ask yourself why you’re investing, and don’t be afraid to tap into your hopes and dreams. There’s no wrong answer (except “to make money”, because duh). Then, write that why down somewhere, because it’ll be the crux of every decision you’ll make about money.

This first step seems a little obvious, but I’m always shocked by the number of people who can’t articulate why they’re investing their money. These same people often become unmoored by the ups and downs of the stock market and end up making rash, emotionally driven decisions at the wrong times.

Lately, our family’s why has been crucially important. We’ve been telling our financial advisor since the jump that we wanted to start a family. We started saving for this possibility months ago. Spending money can be psychologically difficult, but it’s nice to remember that we planned properly for this. The chaos is just the expected victory lap that we’ve taken into account when planning for our other goal (eventual retirement).

Build a process.

I love a good process. It’s all about making thoughtful decisions once so you can go on autopilot forever. Ripping the Band-Aid off, as some say.

Once you have a why, set a goal number — or return, or timeframe — to fulfill that why. After this exercise, you have a rough idea of the amount of money you need to invest and what return you need to make for how long.

From there, you have all the data you need to start sketching out a process. When will you invest this money? From where will you pull the money? What will you invest in, and how will you determine the size and purpose of every piece of your portfolio?

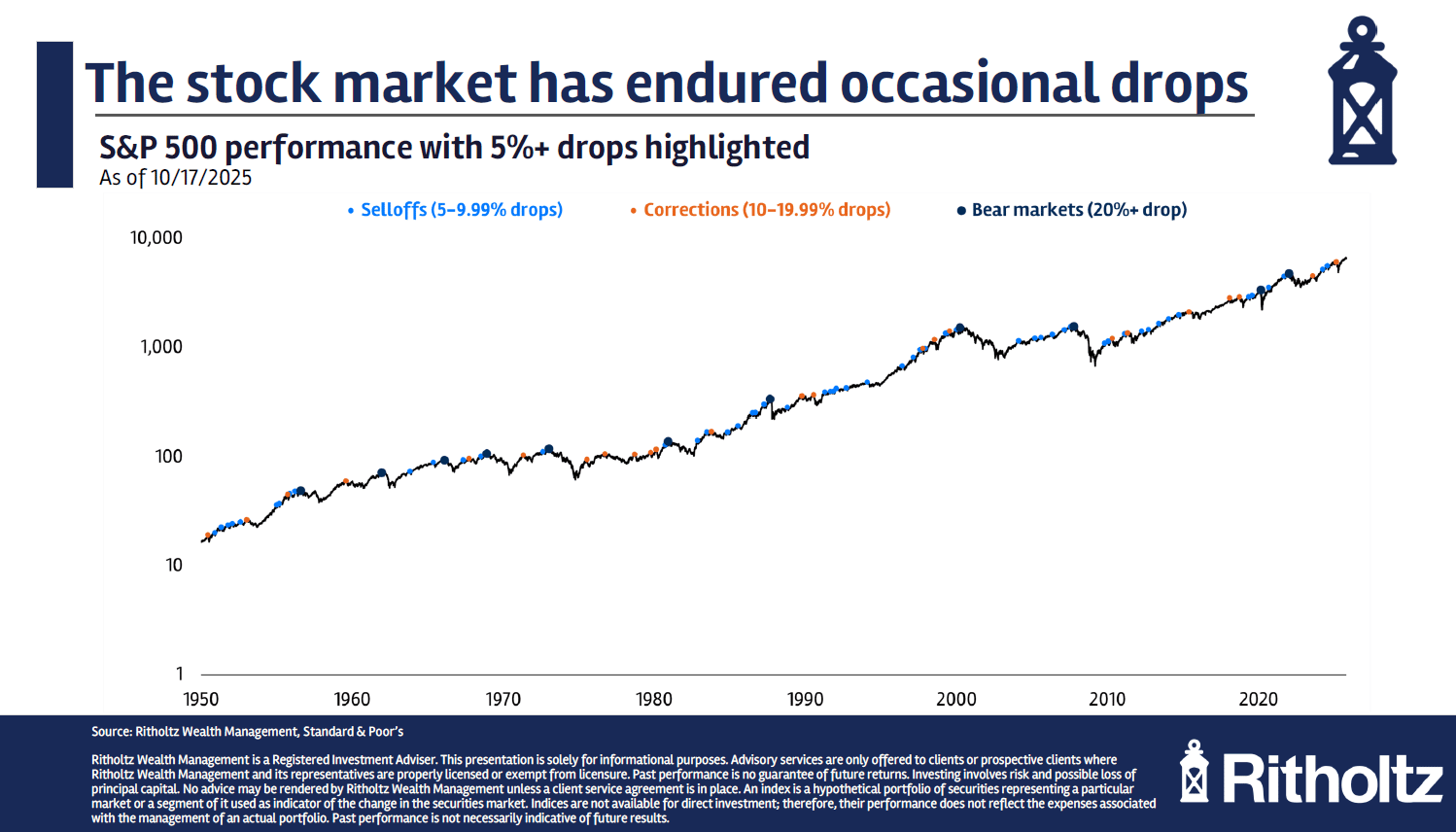

Make a crash plan, since we all know the stock market doesn’t move straight up. What will you do when the S&P 500 falls 20% or more, as it’s done once about every seven years since 1950?

These may be scary scenarios to think about, but you want to decide this when you’re calm and collected. Then, when things fall apart, you have a logic-driven list of steps to follow without a second thought.

My household’s process is simple. Our tax-advantaged contributions are automatically taken out of our paycheck, so we don’t even factor them into our budget. Then, we pay all of our bills and credit card balances and sweep our post-tax brokerage and savings contributions into the appropriate accounts.

And here’s the crazy part: we have a monthly goal for our savings and investments, but I’ve tracked our progress for so long that I know about how much we’ll stash away before our paychecks hit. I also know that these numbers will ebb and flow based on what life stage we’re in, and I have faith that it’ll even out. Yes, even though that faith is being tested these days by two wiggly aliens in my stomach.

We even go so far as to set targets on the assets and funds we own. Seems a little neurotic, but targets help us keep our allocations in line with our needs. The stock market has climbed more than 80% in the past three years, while bonds are up about 20% over the same period. That 60/40 portfolio you’re aiming for just turned into a 70/30.

Let them numbers guide you. They’re as reliable as you’ll get.

Remember your progress.

Tracking your investments over time can be a blessing and a curse. You can go overboard doing this and destroy your sanity over decimal points that barely matter (guilty!).

But when tracking allows you to understand where you are in relation to your goals, it can be the emotional cushion you need as you watch money fly out the door.

Why? Because in most cases, you’ve made more progress than you think.

This is where compounding comes in. That silly time and returns talk I promised I’d set aside? It can help keep you grounded.

My husband and I have been investing in our 401Ks for our entire careers. We collectively started investing in taxable brokerage accounts several years ago, and were lucky enough to stay the course for the entire time (with extra investments when the S&P 500 was in deep selloffs).

People commonly think of their wealth in net worth terms. An absolute number that may sound big or small. And while there’s nothing wrong with that, I’ve found it helpful to think about our investments as a progress bar of sorts. We have a lofty numerical goal for retirement, and we’re X% of the way there. To get to the finish line, we have to save a certain amount per month at a certain rate.

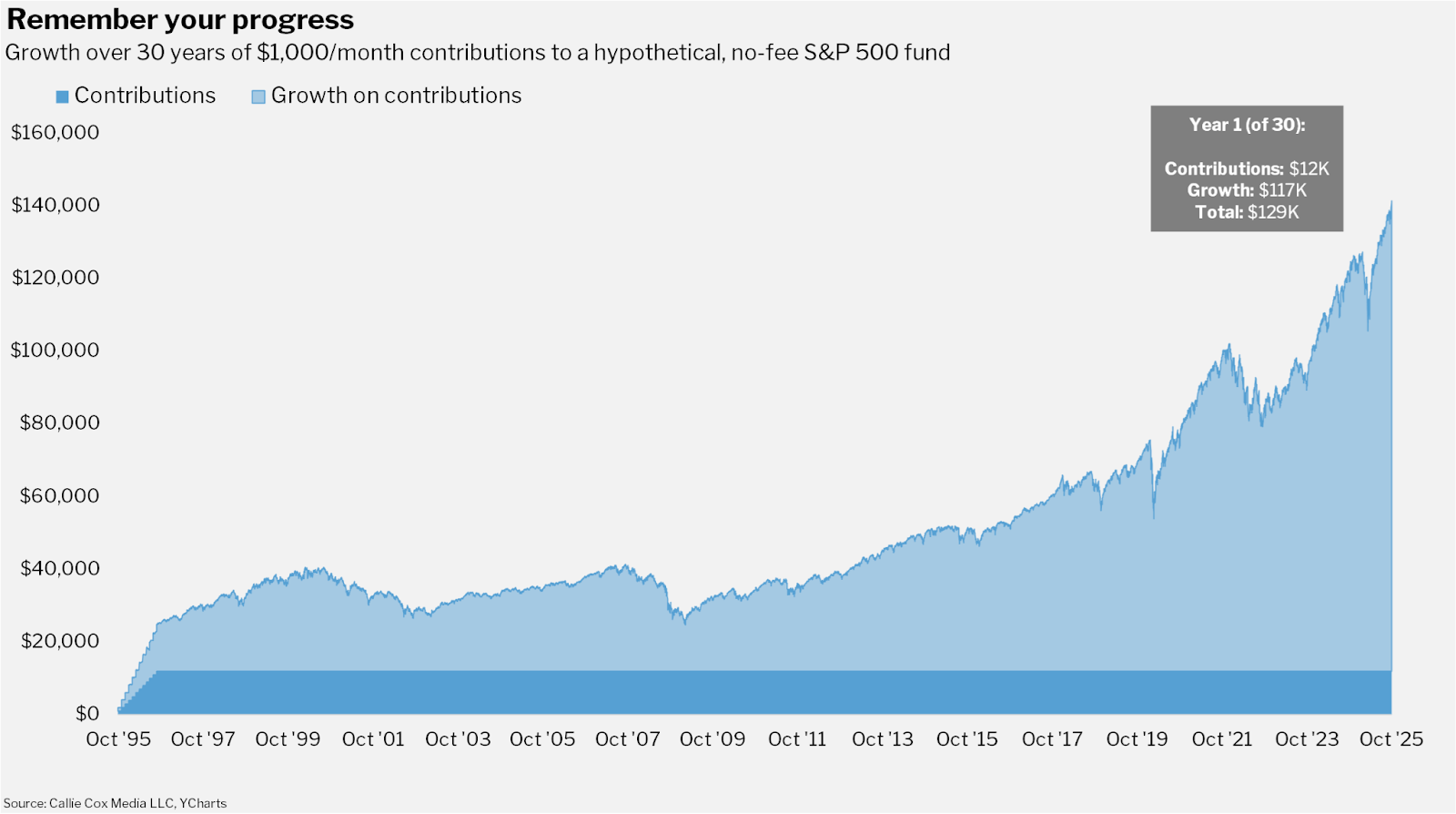

Take the time to do the math, and you might be surprised at how far along you are, mainly because your earliest investments matter the most in your portfolio as time goes on.

Let’s say you started investing $1,000 a month in a hypothetical, no-fee S&P 500 fund 30 years ago. Today, you’d have about $1.68 million sitting in your account. The $12,000 you invested in year 1 has grown 10x to about $129,000 today, or 7.7% of the total portfolio (even though it only accounts for about 3% of the money you’ve invested over the years).

That’s a $117,000 bonus – or nearly 10 years of contributions – just for staying the course.

When you start early, missing a few months of contributions may not matter as much as you think. Is it ideal? No, but life happens. You have to do what’s practical, not perfect.

My colleague Nick Maggiulli has crunched a lot of numbers around this theory. He’s even coined a strategy called “go big, then stop”.

Treat yourself right.

Maintaining your sanity isn’t just a product of investing mindfully. It’s the simple habits in life. Get enough sleep. Watch your caffeine intake. Spend time with the people you love. Have a regular outlet for your nervous energy.

You deserve sanity. If your investing strategy isn’t compatible with your emotional state, you need to change it. Life is too short.

Thanks for reading!

Callie

Like what you just read? Share it with a friend, pretty please 😊