- OptimistiCallie

- Posts

- 👹 Tariff-fied

👹 Tariff-fied

Somebody’s paying the tariffs. Looks like it’s you.

Hey hey, happy Monday.

It’s pushing 100 degrees in North Carolina right now and man, I hope y’all are keeping cool. This summer heat is brutal.

I just wrapped up a week in NYC for business and media meetings, and the topic du jour was tariffs. The conversations were less panicky and more inquisitive, though. If tariffs are so scary, then why aren’t they doing damage to the economy or the stock market?

Well…they’re here. And somebody’s paying them. I’ll tell you the latest in this 5-minute read.

And when you get a minute, watch the Yahoo Finance crew and me on the latest Stocks in Translation episode.

Smash the button below to share OptimistiCallie with a friend 😊

Five months and change ago, I wrote you a last-minute Sunday edition of OptimistiCallie.

The night before, Trump had announced he’d impose historic tariffs on our three largest trading partners – Mexico, Canada and China.

What followed was absolute chaos. Promises that were eventually broken and threats that took Wall Street’s breath away. A tiny poster with indistinguishable rates on penguins that would end up tanking the stock market. Loud, public fights among global leaders.

Today, we seem to be past the worst of the storm, even though we’re all shouldering the highest collective tariff rate in a century. Now, the Trump administration is threatening another round of escalation, with the cliff less than two weeks away.

Where’s the panic, though? Where are those gut-wrenching price tags and Barbie shortages we were all warned about?

Those tariff threats feel a bit like a mirage, don’t they?

Sure, Wall Street says tariffs are about to bite your wallet. But they said that last week. And the week before that, too.

You still found a killer deal on a vacuum during Prime Day festivities, and the only “tariff tax” you’ve paid is on a sketchy fast fashion site that never hesitates to slap an extra fee on your receipt.

And look at the stock market. We’re doing just fine, people!

Well, I’ve scoured through the data, and I’m here to explain everything the numbers are showing us.

Here’s why the hangry tariff monster may still be coming for your wallet.

Somebody’s paying for these tariffs

You may not have encountered a “tariff tax” situation in your life yet. Honestly, I haven’t, although I’ve seen a handful of examples from (rightfully) annoyed friends.

Regardless, somebody’s paying for tariffs. You, the company selling you the item, or the manufacturer/importer of the item.

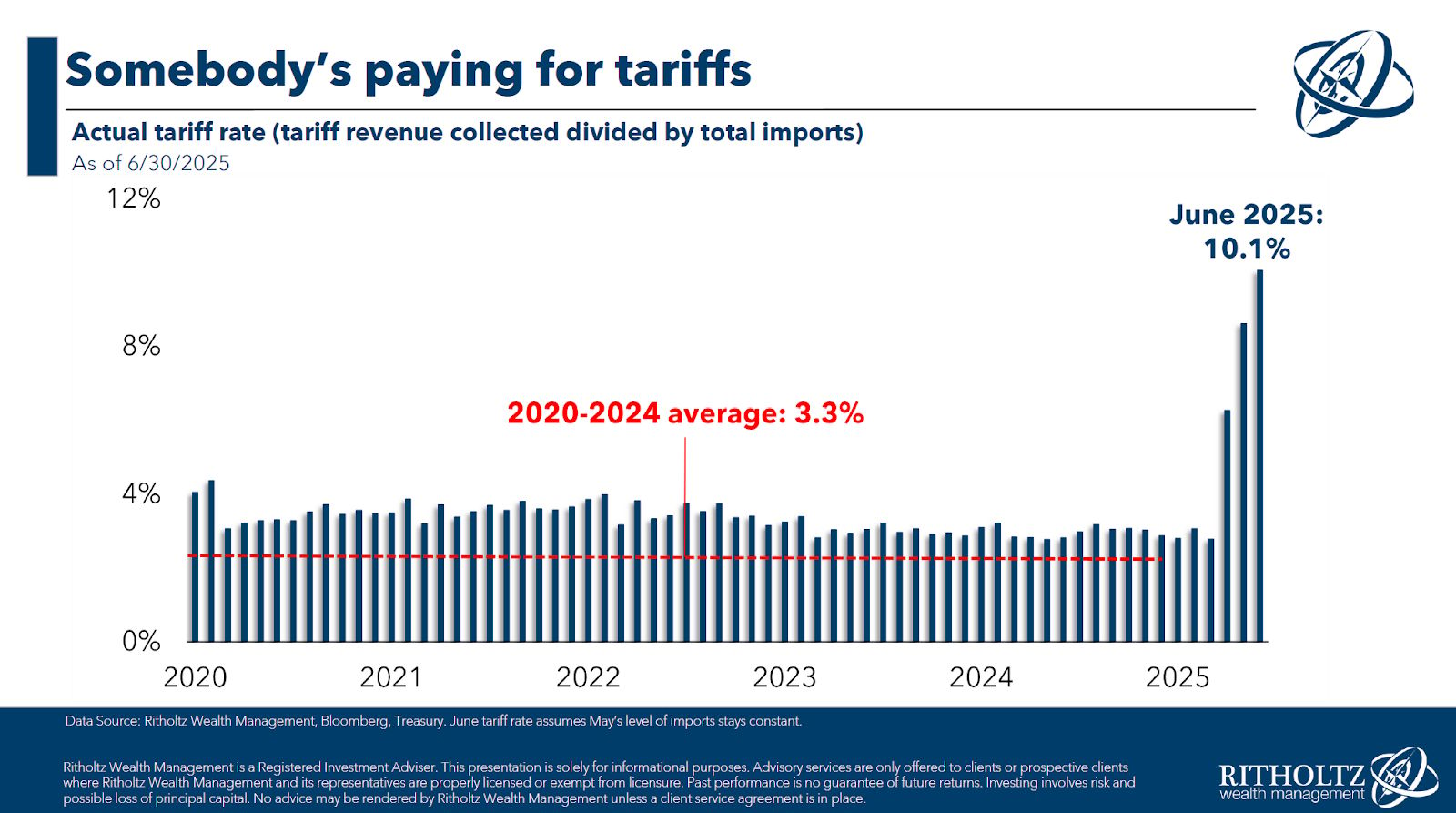

We can see this through data from Treasury, America’s big government bank. Treasury issues daily statements on money coming in and out of the U.S. government, including tariffs collected at ports of entry.

According to these daily receipts, tariff collections have jumped from $9 billion to $28 billion per month this year, boosting the effective tariff rate to around 10% – near the highest in a century.

In a year’s time, that $19 billion of extra tax per month amounts to $228 billion.

If that $228 billion landed in the U.S.’ top 500 public companies’ laps, it’d swallow up about a tenth of the profit they made in 2024.

So far, tariffs are mainly going on our own tabs

Divide that $228 billion by the 132 million households in the U.S., and you have a rough ballpark cost of $1,700 per family.

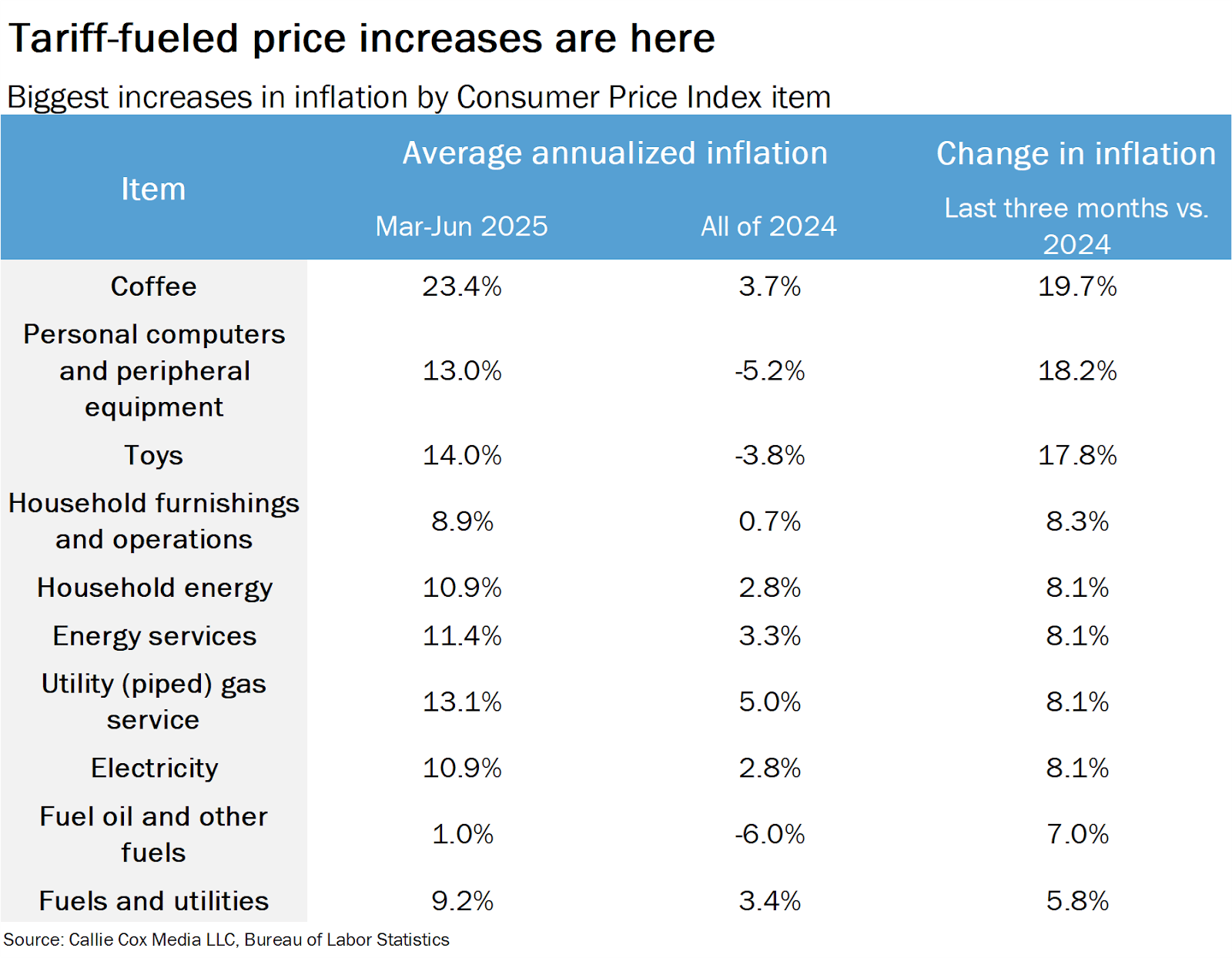

Unfortunately, consumer-facing prices have already started to creep higher on tariff-affected products.

Yes, even if these higher prices don’t feel so burdensome yet.

The cost of computers and computer equipment has grown an astounding 23% (when adjusted to an annual rate) over the past three months. Put simply, at today’s pace of PC inflation, that $1,000 laptop could cost $1,130 within a year. The price tag on toys is rising at an 18% annualized rate, which means a $100 Lego set from March could cost $114 by Christmas.

Inflation is complicated, though. We experience higher costs through the lens of our own lives. If you’re not buying a laptop or Legos, you haven’t felt the pain of a higher price tag.

And even if you’re seething over higher furniture costs during your home renovation, you’re probably finding some comfort in lower prices elsewhere. Like a gallon of gas, which costs 10% less than a year ago.

Or airline tickets and hotel fares, which are down noticeably over the past three months. You’re saving money on that trip to Disneyland, even if you’re paying more for a sofa. All of these price adjustments may net out to zero in your budget.

The problem, however, is when prices start rising across the board. When you can’t help but cringe at your weekly bill because everything is more expensive. We’re not there yet, but this scenario isn’t incredibly far-fetched. If companies have an excuse to raise prices, they often will.

It’s not as simple as avoiding the “made in China” Barbies.

Even higher prices could be coming.

In fact, businesses are already scheming on how to make you pay more.

A June study from the New York Federal Reserve showed that most New York-area companies were already passing along their tariff bills to customers. And in the most recent Beige Book – our interest-rate superheroes’ colorful report on business conditions – Fed regions reported that many firms had already started hiking prices.

Higher prices aren’t just a lever that companies flip on and off, though. There’s a whole science behind when companies incur costs and how easily they can make you pay for them.

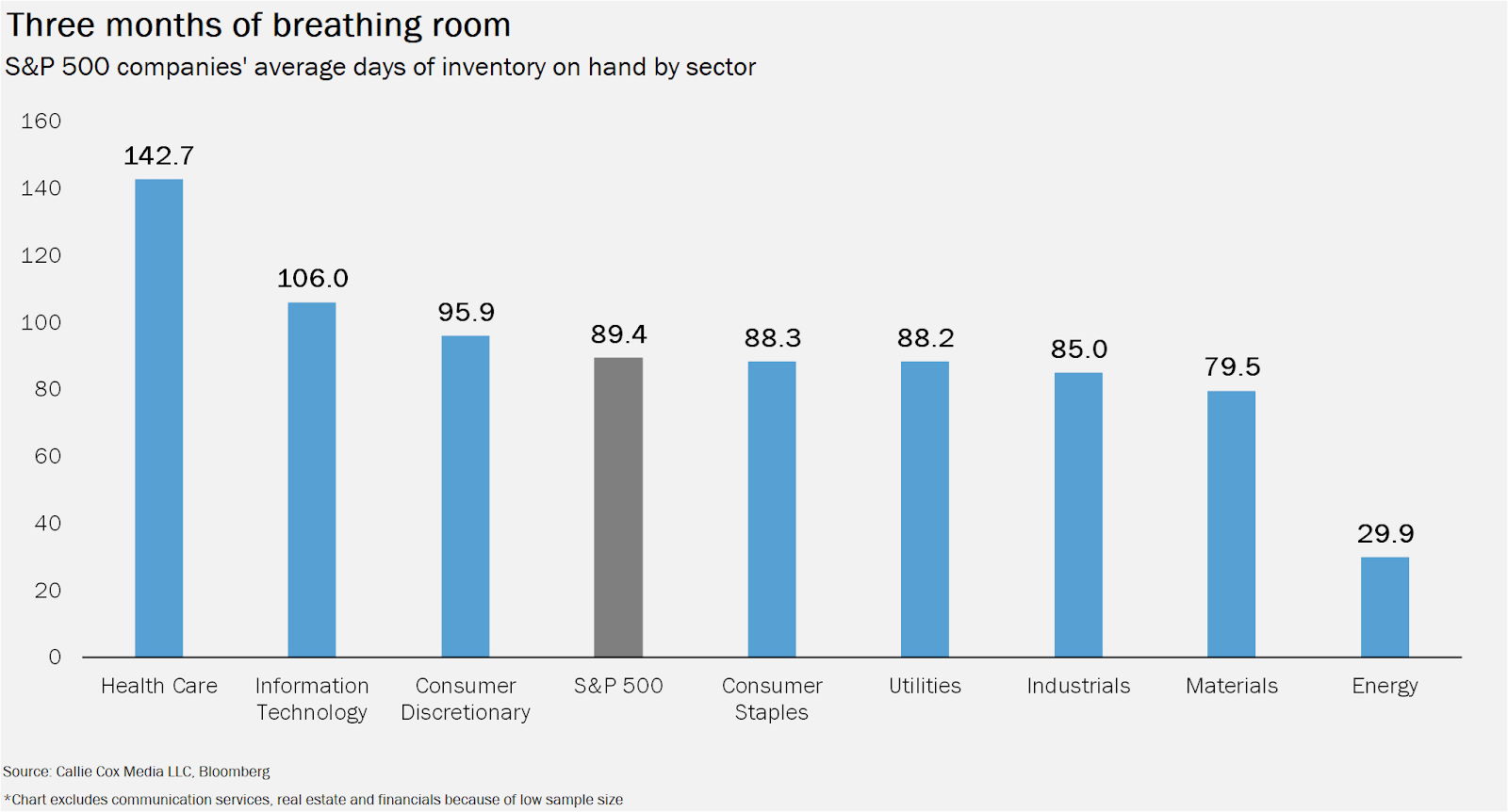

One angle to consider is how quickly businesses cycle through their inventory. Yes, Trump’s reciprocal tariffs went into effect in mid-April. But even the earliest imports subject to these higher tariffs took several weeks to ship from overseas to your local distributor or store.

Many companies bulked up on pre-tariff inventory earlier this year, too, and they may not have to raise new inventory for a while.

Right now, the average S&P 500 company is sitting on about 90 days of inventory, meaning it’d take three months to run out or restock. This number can differ widely across industries, which can explain why tariff-fueled price increases are showing up in some areas and not others.

But on balance, the first round of post-Liberation Day goods may just now be hitting the shelves. These flashes of higher prices may soon become more and more routine on your shopping trips.

Here’s the good news…

Look. All is not lost here. There’s always something to be hopeful about.

While tariffs are terrible policy, we may be in a formidable spot to balance out the blows.

Corporate America was ready for this moment. Remember COVID, when empty shelves were a normal scene and everything from Sriracha sauce to adjustable dumbbells proved tough to find?

Company executives suffered through that mess and said never again, friends! Since then, businesses have focused intensely on supply chain resiliency and manufacturing redundancies. A painful, yet serendipitous trial run for a global trade fiasco.

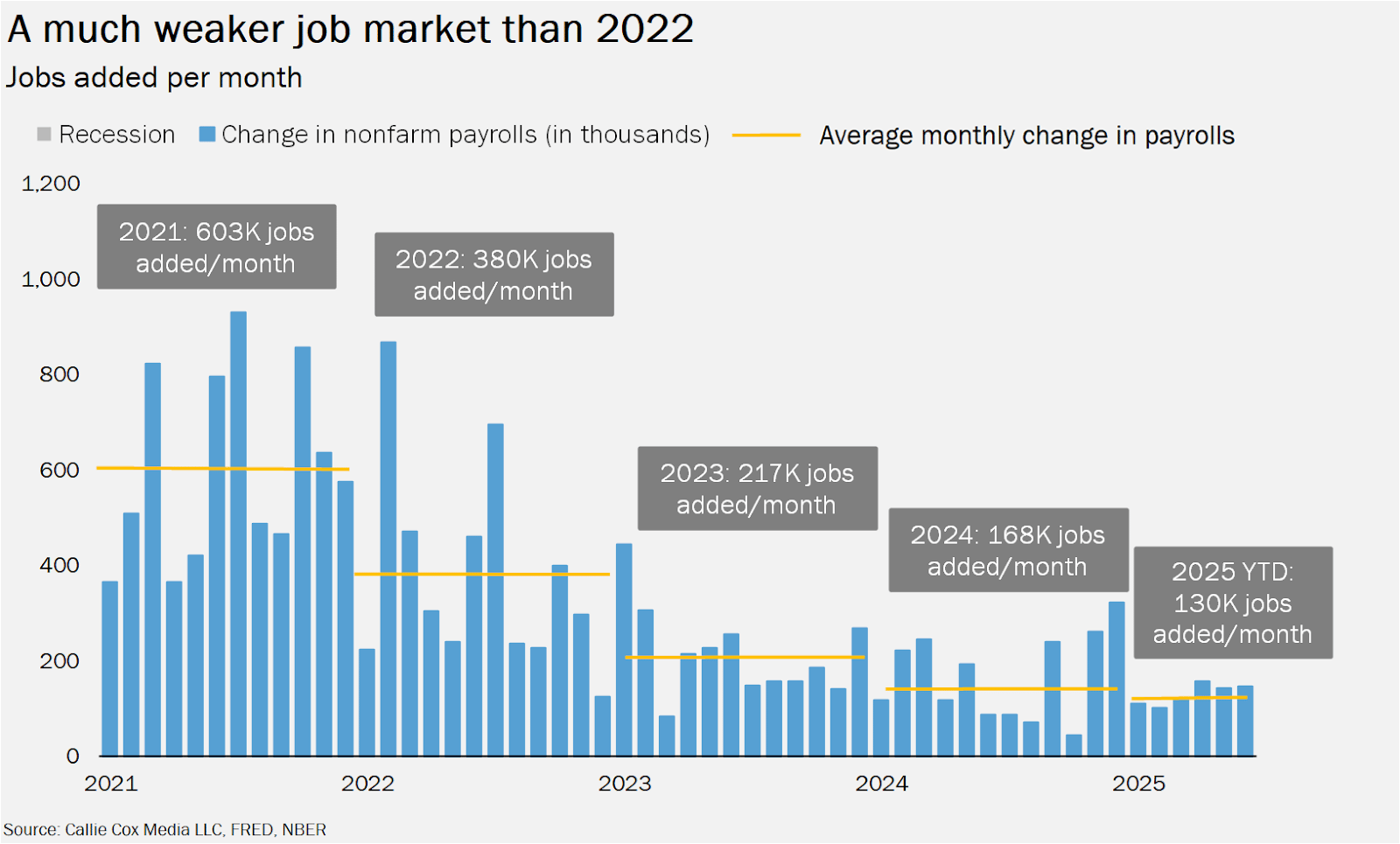

Also, I doubt we’ll see anything like the inflation crisis of 2022. I don’t think companies have THAT much power over prices unless people are willing to pay them. And right now, the job market is looking rough. Much worse than a few years ago, when we were quiet quitting and spending $1,000 for nosebleed Eras tour tickets (guilty!).

I want to be clear here: this isn’t the chart you want to see. But it also isn’t the recipe for scorchingly high prices.

There’s a chance we’ve found a new, weird balance in these post-tariff times. A slower mode of growth that doesn’t devolve into a crisis.

And based on your own personal situation, tariffs may not impact you as much as your friend or neighbor.

Any wise investor wouldn’t put their financial fortunes up to a chance outcome, though.

Invest like an optimist – your long-term goals deserve as much. But don’t go blind to risk.

Thanks for reading!

Callie

Like what you just read? Share it with a friend, pretty please 😊